Pet Trusts (Estate Planning for Pets)

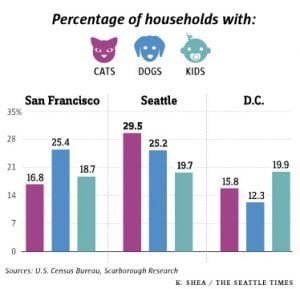

Did you know that there are more pets in Seattle than children? And we aren’t the only pet-loving city: there are approximately 80 million pet dogs and cats in the United States alone. In 2015, pet-parents spent over $60 billion caring for their pets. According to the American Pet Products Association, the average annual spending by a pet-parent in the United States is $967 for dogs and $643 for cats.

Most of us (myself included) consider our pets to be family members – affectionately referred to as our ‘fur-babies’, if you will. However, the vast majority of those pet-parents don’t have a plan for who will care for their companion animals when they’re no longer around.

I’ve met quite a few clients who simply assume that a family member will step in as guardian of the pets. In reality, promises made by friends and family often fail due to allergies, conflict with other pets, and rental properties’ rules regarding pets. Some pet-parents just assume they’ll outlive their pets so there’s no need for planning.

What about emergency situations? Who will take care of your pet if there’s an accident?

There are several ways to plan for your pet’s well-being in the event of your incapacity or death: Wills, Pet Protection Plans, and Pet Trusts. A Will is only valid after death, a Pet Protection Plan is essentially a fill-in-the-blank contract, while a Pet Trust names a guardian for the pet and enlists someone to ensure that this person follows specific instructions.

Pet Protection Plans

A Pet Protection Plan (PPP) is essentially a basic contract that establishes ongoing care for a pet when pet-parents are unable to care for them. Like the Pet Trust, a PPP is valid during the pet-parent’s lifetime as well as after the pet-parent’s death. However, it can’t guarantee that the pet-parent and their pet will remain together in a long-term care facility (only a Pet Trust can do that). The PPP is a simple option and a bit more affordable, but most pet-parents would rather be given the guarantee that their wishes will be followed and their pet is cared for properly.

Pet Planning with Wills

To put it bluntly, a Will is not sufficient and won’t guarantee protection of your pet. First of all, instructions in a Will aren’t enforceable; the purpose of a Will is to distribute property. So any language giving instructions or making requests won’t be legally enforceable. The Court will not enforce your request that your sister Jane regularly take Scout to a specific veterinarian or use a specific amount of money from your estate only for Scout’s care.

Second, there’s going to be a waiting period between the day of your death and the day your Will is submitted to the court to begin the Probate process. It can take weeks or months for your family members to find an attorney they feel comfortable with, make an appointment, hire that attorney, and for the attorney to find time in her or his schedule to begin Probate. And if there’s a dispute among the family or battles with creditors, Probate can last years.

What is your pet going to do in the meantime? Go to the neighbors? Stay with a relative? Will it be safe there? Does that relative have unfriendly pets? Do they have young children who are rough with animals? What happens when your dog defends himself against the guardian’s own pet or child – will he be euthanized? This is already going to be a difficult time for your pet – they’ve lost you, after all. Instability can be frightening and traumatizing for your pet.

Third, Wills distribute assets and property immediately – not over a period of time like with a Trust. So if your Will states that $2,000 will be given to the pet guardian, that person is going to immediately have access to the entire $2,000 and no one will be monitoring how that money is actually spent.

My dog, Philip. © Rachel Bender

Finally, a Will does not “kick in” until after you have died. So what happens to your pet if you become incapacitated? Wills cannot address the possibility that the pet may need to be cared for during the pet-parent’s lifetime.

Pet Trusts

A Pet Trust is a legal document providing for the care and maintenance of a pet in the event of the pet-parent’s incapacity or death. Typically, the pet-parent will name someone (the Trustee) to hold property (usually cash) “in trust” for the benefit of the pet(s), and of course name someone to be the pet’s guardian. The Trustee will make regular payments to the pet guardian specifically to care for the animal(s). This is particularly advantageous for companion animals that have longer life expectancies than cats and dogs, such as horses and parrots. In 2001, Washington enacted RCW § 11.118.005 – 11.118.110, which states Pet Trusts are legally recognized and enforceable documents.

Trusts are legally enforceable documents, so pet-parents can be assured that their instructions will be followed. One of the best aspects of having a Pet Trust is that they can be extremely specific and customized. For example, if your cat only likes a particular brand of food or your dog needs daily walks at his favorite park, or if your pet must go to the veterinarian four times a year, this can be specified in the Pet Trust.

Revocable Pet Trusts can be effective immediately or as soon as the pet-parent becomes unable to care for their pet due to incapacity (sick, injured, comatose, etc.) Since pet-parents know the particular habits of their companion animals better than anyone else, they can describe the kind of care their pets should have and list the person(s) who would be willing to provide that care.

Testamentary Pet Trusts are set up in the provisions of your Will and only goes into effect at your death. Since this Trust does not exist prior to your death, it can be funded out of your estate’s assets.

Furthermore, Trust Administration is a much better alternative to the the court-supervised Probate process. After a pet-parent dies, the Trustee will begin the Trust Administration process – which is typically more efficient and sometimes less expensive than Probate. Additionally, Trust Administration is completely private (a Will becomes a public document when it’s filed with the court for Probate).

One of the most wonderful aspects of a Pet Trust is that it can ensure that the pet-parent and pets will remain together in the event the pet-parents moves to a nursing home or assisted living facility. Studies have shown that seniors receive increasing benefits from their pets—lower blood pressure, increased exercise and circulation, reduced anxiety and stress, boosted mental acuity, enhanced opportunities for social interaction, decreased loneliness, and may even live longer.

Only legally enforceable documents can guarantee a pet’s secure future. Our pets are completely dependent on us for everything – we owe them (and ourselves) the peace of mind that comes with knowing they will always be safe and cared for, even when we aren’t around.

test

I hadn’t ever thought about what would happen to my dog if I passed away! How much on average would it cost to invest in a PPP for a dog?

Hi Riley! Great question. On average, the flat fee for a PPP is about $350.

I assumed pet care could be covered in a will. This knowledge about the downtime between death and a will being enforced is very insightful! A pet trust sounds like a much better path to take.

Hi Charly! We’re so glad to hear that this post has been helpful. Don’t hesitate to contact us if you have any questions about pet planning.

With pet trusts, are things/preferences like brands of food or veterinary visits legally enforceable?

This has definitely brought attention to a factor that I had not previously considered when planning for the future!

I have never even thought about this as a legal issue. Wow! Very unique for you guys to offer this service…